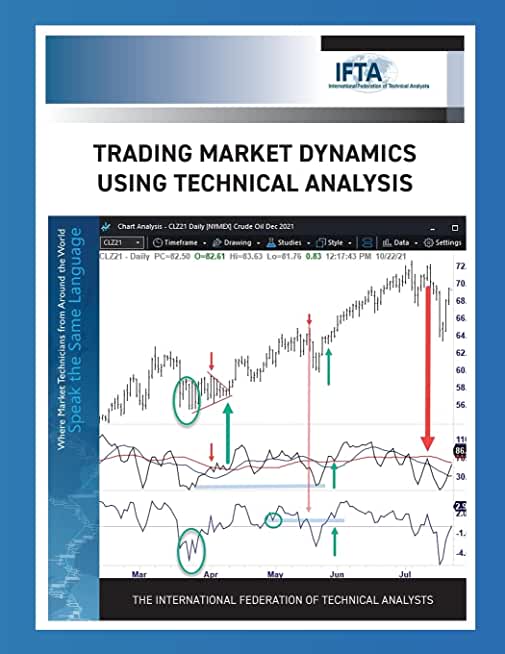

Summary: Now required reading for CFTe certification Level 1 and 2 by the International Federation of Technical Analysts. Applied technical analysis is different than theory. The interaction of signal, timing, and confirmation is critical in today's markets. Trading Market Dynamics is a detailed progression of methods that lead to a final chapter showing how they are used for trading daily intraday signals in a trader's log from January 1-31, 2022. The methods apply for longer horizon positions or short intraday swings. The 10th book by well known author.

Chapter One - Markets or stocks should not be traded as a single symbol. There is always a leading trend to lean on using another market. The global cash flow discussion will show you how to compare markets in detailed charts.

Chapter Two - A two-part chapter that covers classic cycles. It is written in two parts as the material will become required for CFTe levels 1 and 2. Other content is being evaluated for certification.

Chapter Three - How to use MS Excel as a step-by-step guide to examine market correlation objectively.

Chapter Four - Crowd psychology and the market pressure patterns they create.

Chapter Five - Essential and written to correct industry misunderstandings and under-utilization of oscillators. Includes original charts and text of George Lane's original week long course. Understand why you need both normalized and unbound oscillators in volatility. Learn why the best signals are NOT divergence signals but formations that repeat in the mid-range of travel giving signal probabilities.

Chapter Six - Needed to understand Brown's entry/exit and risk assessment criteria.

Chapter Seven - This chapter tracks the entire month of January 2022 in an daily intraday trading log of NASDAQ. All the logic, study and prep each evening, then trading as a running dialog written in real-time. Time periods drop from daily down to 4-minute charts as needed. It became a period of market transition that required most of the methods described earlier in the book. The chapter in retrospect shows how applied technical analysis is used in battle during an historic rollover in the NASDAQ.

FULL COLOR, 398 pages, 8.5 by 11 inches, 2.8 pounds.

(Beginner to Intermediate level)-provided by the Author.

ISBN-978-0-578-38286-9 (alk. paper)

1. Investment analysis. 2. Speculation. 3. Technical Analysis.